Effective Techniques to Stop Nightmares in 2025 Nightmares can be distressing and can significantly impact our overall sleep quality. As we navigate life in 2025, it's essential to explore effective ways to stop nightmares and foster a restful night's sleep. Nightmares often stem from stress, anxiety, or unresolved fears, which is why understanding their triggers and working towards relief strategies is...

Effective Ways to Perfectly Boil Spaghetti in 2025 Boiling spaghetti might seem straightforward, yet there are numerous nuances to achieve perfect results. Perfectly boiled spaghetti is the foundation of countless dishes and a favorite in many households. Understanding how to boil spaghetti correctly involves more than just timing; it includes the right techniques, tools, and tips that can elevate a simple...

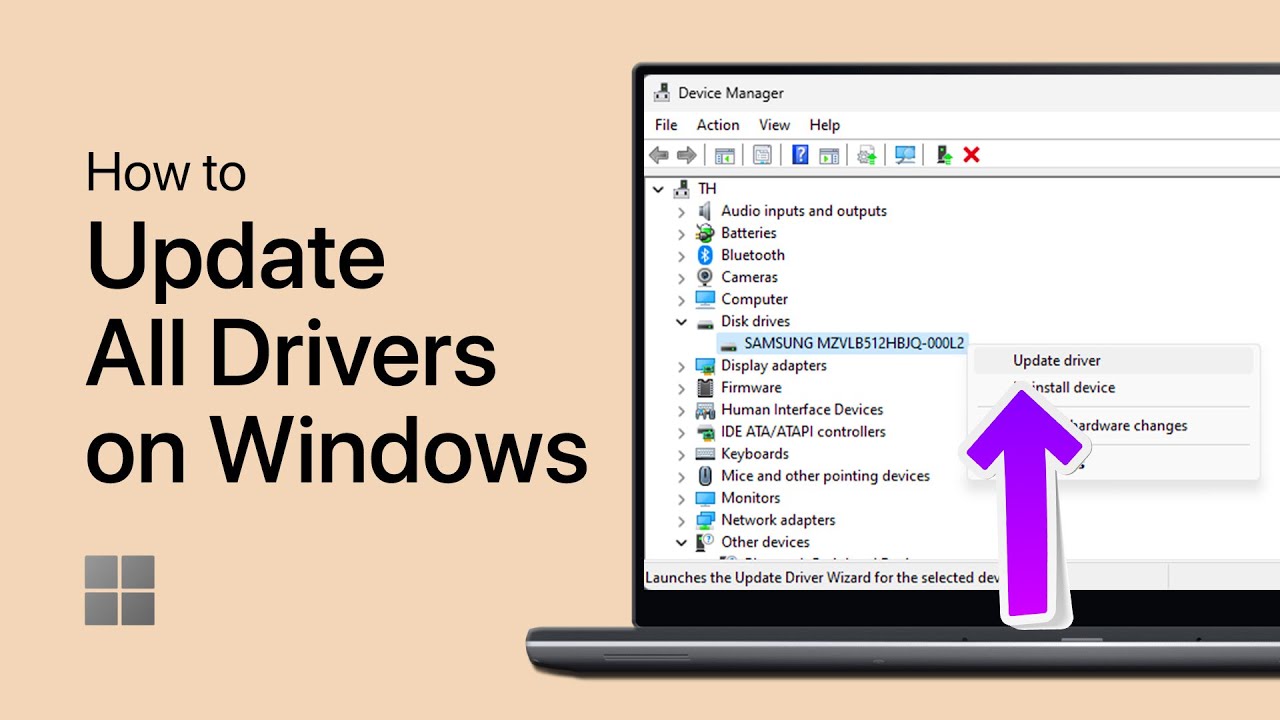

Effective Ways to Reset Your Computer in 2025 Resetting your computer can often be necessary to refresh performance, resolve issues, or simply start over clean. In 2025, advanced techniques and user-friendly options make the process easier than ever. Knowing how to reset your computer not only enhances its functionality but can also protect your personal data and ensure a smooth user...

Smart Ways to Grill Chicken Wings for Perfect Results in 2025 Grilling chicken wings is an art that combines flavor, technique, and timing. As party snacks or game day necessities, they can elevate any gathering. The key to perfect grilled chicken wings lies in understanding how long to grill chicken wings, selecting the right marinade, and using effective grilling techniques. In...

Smart Ways to Transfer Phone Number to a New Phone in 2025 Transferring your phone number to a new phone has become more seamless and efficient over the years. With the rapid advancements in mobile technology, understanding the phone number transfer process in 2025 ensures that you can maintain your connectivity with minimal disruptions. Whether you’re switching carriers, upgrading devices, or...

Effective Addition Techniques for Fractions Understanding Proper and Improper Fractions When working with fractions, it's essential to know the difference between proper and improper fractions. A proper fraction has a numerator smaller than its denominator, while an improper fraction has a numerator that is equal to or larger than the denominator. Understanding these concepts is crucial when adding fractions, as it helps...

Effective Ways to Improve Your Digestive Health with Probiotics in 2025 Understanding Probiotics and Their Importance Probiotics are live microorganisms that confer health benefits, particularly for digestive health. As we dive into 2025, the significance of maintaining a balanced gut microbiome is at the forefront of health discussions. Probiotics play a critical role in optimizing intestinal health, enhancing overall well-being, and improving...

Effective Ways to Wash a Backpack for Practical Use in 2025 Backpacks are essential companions for both daily commuting and adventurous travels. However, over time, they accumulate dirt, odors, and stains that can affect their functionality and appearance. Understanding how to wash a backpack effectively is crucial in maintaining its longevity and hygiene. This article will explore various cleaning methods for...

Essential Guide to Watching Mike Tyson Fights in 2025 Mike Tyson, one of the most iconic figures in the boxing world, continues to captivate audiences far and wide. As we look ahead to 2025, the excitement surrounding a potential Mike Tyson fight is palpable. Whether you're a long-time fan or a newcomer eager to experience the thrill, knowing how to watch...

Best 10 Ways to Get Paid on Instagram in 2025 Instagram continues to evolve as a potent platform for monetization opportunities. With an increasing number of users and brands realizing its potential, understanding how to leverage Instagram for income generation is vital for aspiring influencers and businesses alike. The landscape of earning on Instagram is changing in 2025, emphasizing the importance...