Smart Guide to Using QuickBooks: Effective Tips for Better Management in 2025

In today’s fast-paced business environment, understanding how to use QuickBooks effectively can significantly enhance your accounting practices. As an indispensable tool for small and medium-sized businesses, QuickBooks accounting software offers a plethora of features that streamline various financial processes. This guide provides insightful tips and actionable advice for maximizing your QuickBooks experience in 2025, covering everything from the QuickBooks setup guide to advanced features.

Getting Started with QuickBooks

To fully leverage the capabilities of QuickBooks, it’s essential to start with a solid foundation. The QuickBooks setup guide is your first step toward harnessing the power of this accounting software. During the setup, you’ll configure your business profile, select the appropriate version (Online or Desktop), and connect your bank accounts.

Configuring Your QuickBooks Account

The initial configuration is crucial for effective usage. Begin by selecting the right QuickBooks version that fits your business needs. Whether you opt for QuickBooks Online or QuickBooks Desktop, ensure the installation follows the recommended guidelines. During setup, customize your chart of accounts, which categorizes your finances. This helps streamline your reporting and provides clearer insights into your business’s financial health. Integrating your preferred payment processors during setup will also help improve cash flow management and automate invoicing.

Understanding QuickBooks Features

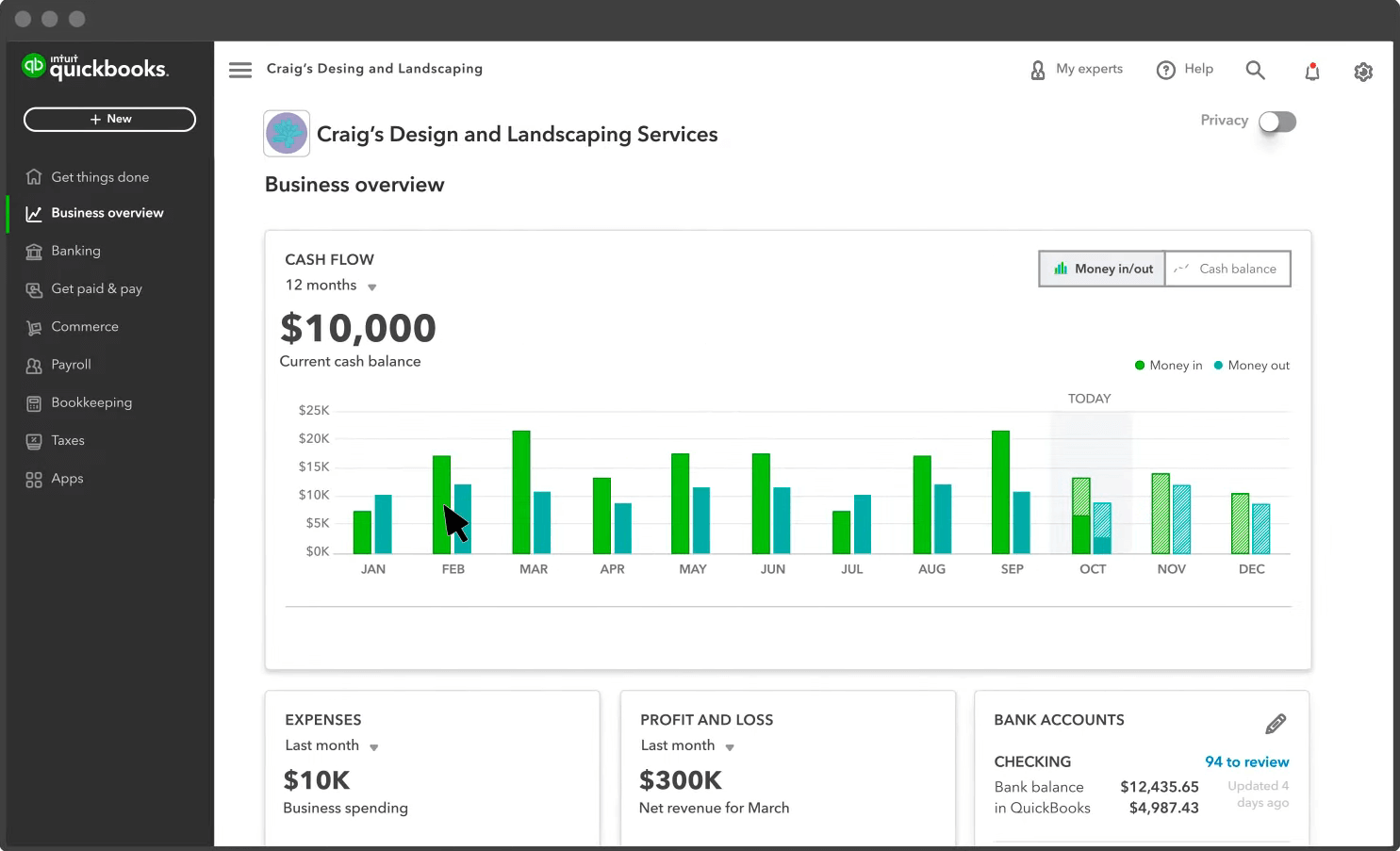

This powerful software includes a wealth of features designed to assist with various aspects of financial management. Key functionalities include QuickBooks invoicing, where you can create customized invoices and automate payment reminders to reduce late payments. Additionally, the QuickBooks expense tracking feature empowers you to monitor expenses effectively, categorize them in real-time, and keep your financial records organized. Don’t overlook the impressiveness of QuickBooks reporting, which provides insights on cash flow and overall business performance through accessible dashboards.

Essential Tips for Successful QuickBooks Utilization

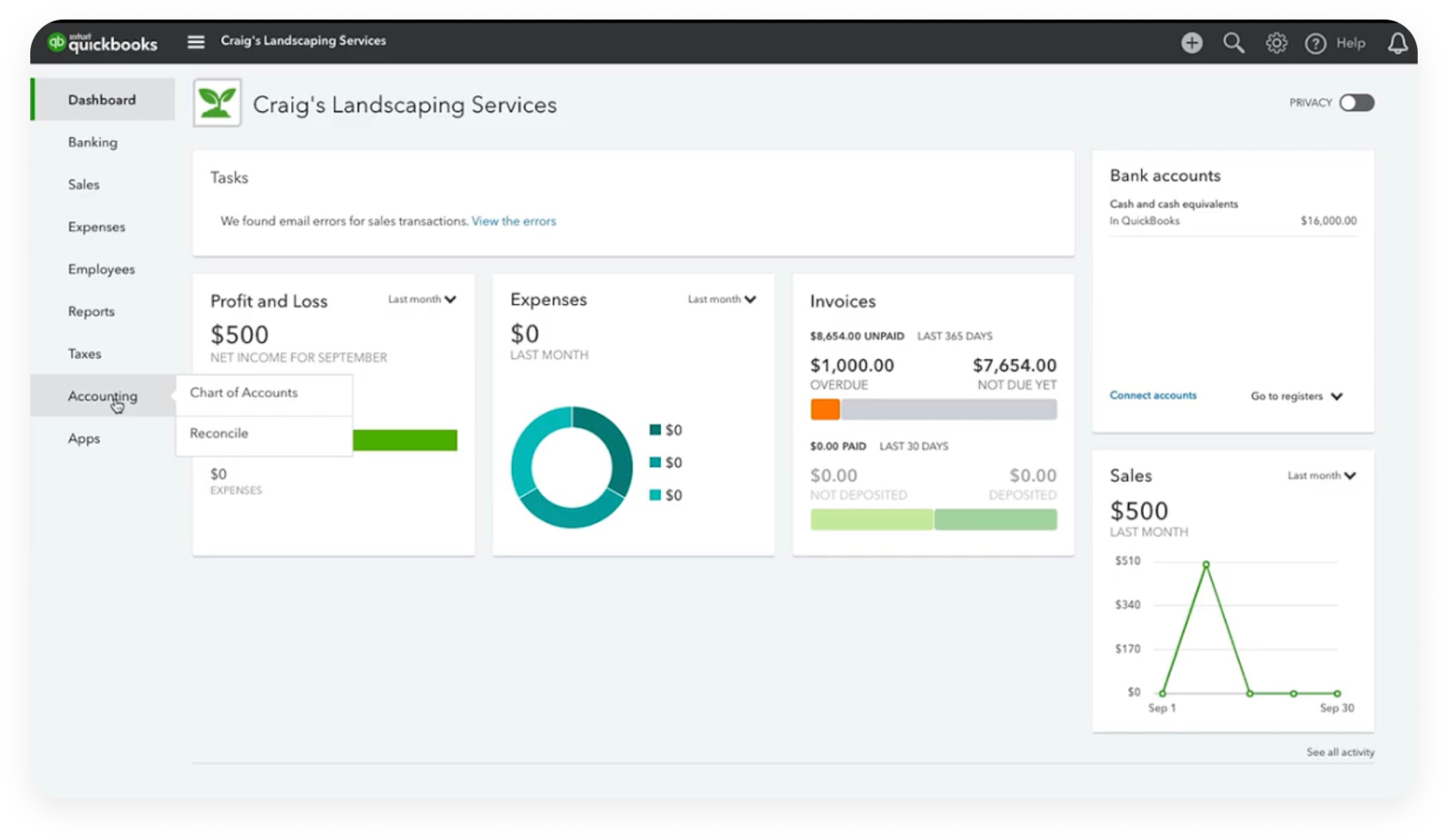

Maximizing your experience with QuickBooks requires understanding its most effective use cases. Implementing features like QuickBooks budgeting helps you manage your expenses predictably. Keeping your account reconciliation regular—preferably monthly—can catch and eliminate discrepancies early. Make the most of your QuickBooks integrations—there’s a dedicated app store where you can find tools that work seamlessly with QuickBooks to enhance functionality, ranging from CRM to project management applications.

Advanced Features of QuickBooks

Once you’re comfortable with the basics, it’s time to explore the advanced features. QuickBooks effectively scales alongside your business, offering functionalities such as QuickBooks payroll, QuickBooks inventory management, and more. Staying informed about key features helps you adapt and plan your growth accordingly.

Leveraging QuickBooks for Payroll Management

Managing payroll is a significant aspect of any business’s operations. With the QuickBooks payroll feature, you can automate wages, file taxes, track time for employees, and access comprehensive payroll reports. This reduces manual errors, and the automated reminders regarding tax payments save you from late fees. It’s particularly beneficial if using the QuickBooks mobile app for on-the-go management and checking payroll hours directly.

Effective Use of QuickBooks for Financial Analysis

Utilizing QuickBooks financial reporting enhances your ability to make informed business decisions. Regularly generate quarterly or annual reports to analyze profitability and growth trends. Combined with QuickBooks budgeting, you gain competitively substantial control over your financial strategies, allowing for adjustments based on thorough analysis of QuickBooks data.

Performing Routine Maintenance with QuickBooks

Maintenance is essential for the uninterrupted functionality of any software, and QuickBooks is no exemption. Regularly checking for QuickBooks updates ensures you gain immediate access to new features or crucial security patches. Additionally, periodically conducting system audits will pinpoint discrepancies or errors within your accounts, allowing you to rectify them swiftly.

Common Troubleshooting Steps in QuickBooks

Like any software, users may encounter issues over time. Knowing basic troubleshooting can save you hours of stress. QuickBooks offers extensive customer support resources, but familiarizing yourself with common problems and their fixes is vital.

Identifying Common QuickBooks Errors

QuickBooks users often face specific errors, particularly during data import or banking reconciliations. Common error codes include 6123 (often related to your company file being corrupted) or 80029c4a (which indicates an issue with the installation). Knowing these faults and their solutions upfront simplifies rectifying issues without potholes. Always back up your data periodically as a best practice.

Utilizing QuickBooks User Support Resources

To avoid feelings of isolation, leverage the incredible support centers created by the QuickBooks community. They provide user guides, frequently asked questions, and seminars perfect for QuickBooks training. You can also watch QuickBooks tutorial videos that delve into specific features and troubleshooting tips—these are particularly useful for visual learners.

Active Participation in the QuickBooks Community

Engaging with community forums offers compelling insights from fellow users, including strategic tips on leveraging QuickBooks advanced features for varying business industries. You might discover innovative ways to tackle common business issues shared among stakeholders in these communities. Networking can be just as useful when seeking solutions or using specific features efficiently.

Key Takeaways

- Start with a proper setup of QuickBooks to take full advantage of its features.

- Explore and implement QuickBooks features like invoicing and expense tracking for improved financial management.

- Regular updates and maintenance are crucial for optimal performance.

- Utilize community support and troubleshooting resources effectively for troubleshooting.

- Harness QuickBooks analytical tools for budget creation and financial insight generation.

FAQ

1. What is the best way to set up QuickBooks for my small business?

When setting up QuickBooks for your small business, ensure you gather all necessary financial documents beforehand. Utilize the QuickBooks setup guide to configure company settings accurately. It’s advisable to choose between QuickBooks Online or QuickBooks Desktop based on your scalability requirements. Create your chart of accounts tailored to your business’s needs for easier navigation.

2. Can I integrate QuickBooks with other software?

Yes, QuickBooks offers numerous integration options with various apps for enhancing productivity. Popular integrations include CRM systems and eCommerce platforms. By utilizing QuickBooks integrations, you can streamline your processes and automate data flow between different applications.

3. How do I generate financial reports in QuickBooks?

To create financial reports in QuickBooks, navigate to the Reporting tab within the software. Here, you can choose from various report options, such as profit and loss statements, balance sheets, or expense reports. Customize the parameters, select your dates, and generate the desired reports for thorough financial oversight.

4. Is there training available for QuickBooks users?

Absolutely, QuickBooks provides various resources including video tutorials, user documentation, and online seminars. These resources are particularly helpful for QuickBooks for beginners. Engaging in these will enhance your understanding of the software’s features and optimize your using experience.

5. What are some tips for better QuickBooks management?

For better management with QuickBooks, keep your software updated regularly, reconcile your accounts monthly, and take advantage of budget tracking features. Additionally, make use of the QuickBooks mobile app for on-the-go management and consider integrating useful apps for expanded functionality. Familiarizing yourself with QuickBooks problems and solutions will streamline your support usage.

6. How does QuickBooks assist in tax preparation?

QuickBooks facilitates simpler tax preparations by organizing your financial data throughout the year. During tax season, you can generate tax summaries quickly; features like QuickBooks tax preparation automate tax calculations and ensure you’re prepared to file efficiently, minimizing significantly the stress associated with manual tracking.

7. What is the difference between QuickBooks Online and QuickBooks Desktop?

The primary difference between QuickBooks Online and QuickBooks Desktop lies in the accessibility and features. QuickBooks Online offers cloud storage allowing access from any device, while Desktop is more feature-rich in data handling. Depending on your needs regarding connectivity and functional specifics, either option may serve your business adequately.